|

|

Post by nickd on Aug 14, 2011 11:47:36 GMT 1

(49 Continued) George puts his emphasis on the following in his comprehensive spending review document:"Introduces fundamental reforms to simplify the welfare system, promoting work and personal responsibility through the new Universal Credit as well as providing enhanced support for those with the greatest barriers to employment through the Work Programme. The Universal Credit will be introduced over two Parliaments to replace the current complex system of means tested working age benefits. It will ensure that work always pays and reduce fraud and error, while helping ensure that the welfare system is affordable; Spending Review 2010 puts the welfare system on a sustainable footing, making net welfare savings of £7 billion a year, including through withdrawing Child Benefit from families with a higher rate taxpayer, reforming Employment and Support Allowance, controlling the cost of tax credits, and capping the amount a work less household can receive in benefits to no more than an average family gets by going out to work; This is how he envisages savings will be phased in year on year2011/2012 = £320M 2012/2013 = £2,555M 2013/2014 = £5,990M 2014/2015 = £7,040M The prediction is that by 2015 the savings will be £7 Billion (well 7040 million) The CSR makes it clear that the biggest savings will be in the time limiting of ESA claims to 12 months at £2,010 million (say 2 billion) and Child Benefit at 2,500 (say 2.5 billion). It's a bit of a let down with DLA reductions only giving him an estimated saving of £135 million by restricting DLA mobility payments to those in residential care. A more substantial area of savings comes from Working & Child Tax Credits at a combination of £385M + £390M + £300M providing £1,185M against which you deduct £560M for increases in the child elements which are set to rise. Unsurprisingly, we haven't heard too much about the estimated savings of £490 million which he plans to achieve by localising and reducing Council Tax (and the benefit changes which go with it) The capping of benefits and housing benefit restriction is set to save £485M. There are minus changes in cumulative growth on work and pensions expenditure amounting to £5.5 billion on Departmental budgets. But we'll stick with these estimated £7 billion savings for now because they are what George needs to show us he can deliver. In his CSR review he puts further emphasis on "How the Government is radically simplifying the existing benefits system through the creation of a new Universal Credit, to ensure that it always pays to work;" • The Government is providing enhanced support for those with the greatest barriers to employment through the Work Programme, incentivising specialist private providers through an innovative payment by results mechanism. •The Government is ensuring the Jobcentre Plus network can continue to provide support that is internationally acclaimed as effective in getting people back into work. So broadly speaking we can see which way he's headed, it's not quite in line with Freud on Fraud or living up to the populist tabloid headlines though is it?

Question is to deliver £7 billion in savings how much is it all going to cost? Mmm, now that is the question. Link to comprehensive savings review document cdn.hm-treasury.gov.uk/sr2010_completereport.pdf

|

|

|

|

Post by johnnybegood on Aug 14, 2011 20:10:42 GMT 1

you have PM's

|

|

|

|

Post by nickd on Aug 14, 2011 22:08:13 GMT 1

Thanks Johnnybegood - both replied to.

|

|

|

|

Post by nickd on Aug 14, 2011 22:09:16 GMT 1

(50) The political spending history of welfare reform

It's important to consider this aspect because all parties claim different things when it comes to their respective track records on welfare reform.

So let's just examine their respective records on spending.

Who spends the most? Or is it Or is it What do you reckon? What do you reckon?Well it's interesting to listen to what the IFS say.. "The late 1980s saw the first substantial fall in social security spending as a share of GDP since 1948–49. This was the result of rapid economic growth and the associated fall in claimant unemployment, combined with the fact that many benefits, the most notable of which was the Basic State Pension, were only increased in line with inflation. The economic downturn in the early 1990s, however, saw the economy contract and unemployment rise to 2.9 million. This led to another dramatic rise in the share of national income spent on social security, which reached an historic high of almost 13 per cent in 1993–94. After that, social security spending fell as a share of GDP, as the economy grew and the unemployment count dropped. The proportion of GDP allocated to social security expenditure gradually increased following the turn of the millennium, despite continued economic growth. This was mainly due to the increasing generosity of benefits targeted at pensioners (e.g. the Pension Credit) and families with children (e.g. the Child Tax Credit). Largely as a result of the recent recession, expenditure as a proportion of GDP rose substantially from 11.38% in 2007-08 to 13.74% in 2009-10 (due both to an increase in benefit payments to the newly unemployed and the lower level of GDP)." ----------------------------------------------------------------------------------- So let's not forget that under the Conservatives the unemployment count ran at a record 2.9 million. Let's not also forget that in 1999 (two years after Labour came to power in 1997 the incapacity claimant count stood at 2,655.38 - almost exactly the same as it was in 2009.

Let's also not forget it was the Conservatives who introduced Disability Living Allowance in 1992 and Incapacity Benefit in 1995, I say this because these are two benefits they now condemn with alarming regularity.

But one of the most interesting figures is to be found in the IFS 2010 report at page 85 under Appendix A. Benefit Expenditure from 1948–49 to 2009–10 - Table A.1. Spending on benefits in cash terms and real terms (2009-10 prices), real increases and spending as a share of GDP.

In 'real' terms over the life time of Conservatives the welfare bill went up on average by 3.64% every year whereas under the Labour administration it was less at 3.16% per year.

So now you know!There are schools of thought which say that the Conservatives shipped high numbers of the unemployed over to Incapacity benefit from 1995 to conceal their embarrasment at running such high numbers of people out of work; - the figures seem to bear this analogy out but hey, it's not for me to get political. Link... www.ifs.org.uk/bns/bn13.pdf

|

|

|

|

Post by johnnybegood on Aug 15, 2011 21:06:58 GMT 1

not sure where to post this - can you move it to appropriate place please?! Anyone who provides welfare and benefits advice or undertakes casework in this area - only a few days left to submit your views In November of last year, Professor Harrington's Independent Review of the Work Capability Assessment made a number of recommendations on how the process could be improved. The Government accepted these recommendations and started implementing them. The Disability Benefits Consortium (DBC) wants to gauge what the impact of these recommendations has been by collecting the views of welfare advisers and caseworkers. This survey will be used to feed into the second year of Professor Harrington's review of the Work Capability Assessment and will help to ensure that any further improvements that are needed to the process are made. The survey should only take around 10 minutes to complete.

www.surveymonkey.com/s/wca_year_one_recs |

|

|

|

Post by nickd on Aug 16, 2011 8:38:40 GMT 1

Johnnybegood: Let's leave it where it is for now, I'll move it a bit later and give it some prominence. I'm a bit pushed for time now, if you go to 'home' and then go to the relevant section you can start a 'new thread' and just copy and paste into that? You can give it a new name that way and it will stand alone? - any probs, I'll sort them out.

|

|

|

|

Post by nickd on Aug 16, 2011 15:35:34 GMT 1

(51) Here's an interesting article posted by Jman on Ilegal and also brought to my attention by Johnnybegood; - it highlights one of the hidden costs of these shambolic welfare reforms. The potential costs of our clinicians putting targets before their duty of care.

ATOS may be contracted by the DWP

But they shouldn't forget their professional duty as doctors

and nurses.

Read how 12 Atos Healthcare Professionals could be struck offin this article which appeared in the Observer/Guardian

"Atos doctors could be struck off"[/u] Twelve medics at the disability assessment centre are under investigation by the GMC over allegations of improper conduct Daniel Boffey, policy editor guardian.co.uk, Saturday 13 August 2011 Twelve doctors employed by the firm that is paid £100m a year to assess people claiming disability benefit are under investigation by the General Medical Council over allegations of improper conduct. The doctors, who work for Atos Healthcare, a French-owned company recently criticised by MPs for its practices, face being struck off if they are found not to have put the care of patients first. The Observer has found that seven of the doctors have been under investigation for more than seven months. The other five were placed under investigation this year following complaints about their conduct. It is understood that the majority of allegations concern the treatment of vulnerable people when the government's controversial "work capability assessments" were carried out, but the GMC refused to comment on individual cases. The development will add to fears over the pace and radical agenda behind the government's welfare-to-work policy, which led to protests in Westminster in May by thousands of disabled people. It will also raise concerns about ministers' commitment to Atos Healthcare, which was recently granted a three-year extension on its contract................" Rest at link below : www.guardian.co.uk/politics/2011/....duct-disability* thanks to Johhnybegood and Jman for flagging this up.

|

|

|

|

Post by nickd on Aug 19, 2011 9:05:37 GMT 1

(52) Unemployment on the rise Jobcentres will only be effective;- providing they have vacanciesAs if things aren't bad enough, a rising tide of the number of people out of work, increasing doubt over the role of the ATOS clinicians and consequent escalation of costs all threaten the smooth implementation of welfare reform. The recent riots has government in a spin over how it should punish offeders by benefit sanctions; - it may grab the attention of voters swayed by populist headlines - but won't it just introduce more complexity, more law and ultimately make it difficult to set the goalposts? Jobcentres will only be effective;- providing they have vacanciesAs if things aren't bad enough, a rising tide of the number of people out of work, increasing doubt over the role of the ATOS clinicians and consequent escalation of costs all threaten the smooth implementation of welfare reform. The recent riots has government in a spin over how it should punish offeders by benefit sanctions; - it may grab the attention of voters swayed by populist headlines - but won't it just introduce more complexity, more law and ultimately make it difficult to set the goalposts?

Not to mention bring about even more appeals?

We're in for a rough rideThe number of people out of work is on the up, unemployment is rising at a faster pace than private sector job creation; - which must come as a dissapointment to the coalition government in terms of their hopes for future growth. What I'd like to know is the real statistics for people currently claiming IB, IS for IB, ESA (both variants) and JSA (both variants) and how they're tracking these figures. One factor they don't seem to factor in is how the increased JSA stats can be partly put down to an increase in claims related to ESA refusals. Watch the ministers and their scripted messages on 3 separate videos on Mylegal - Unemployment - 'The Ministry Of Excuses' It's surprising how they seem to now accept it's the world market decline which is a factor, - not really what they've said in the past. Listen to George Osborne, Chris Grayling and David Cameron via 3 videos and make up your mind as to whether they'll be able to stop the numbers of unemployed people rising even further mylegal.org.uk/index.cgi?board=frontline&action=display&thread=421

|

|

|

|

Post by nickd on Aug 20, 2011 20:10:38 GMT 1

(53) So are Government's plans on welfare reform simply just a lot of hot air? Will these reforms put welfare on cloud 9 or in cloud cuckoo land? Will these reforms put welfare on cloud 9 or in cloud cuckoo land?

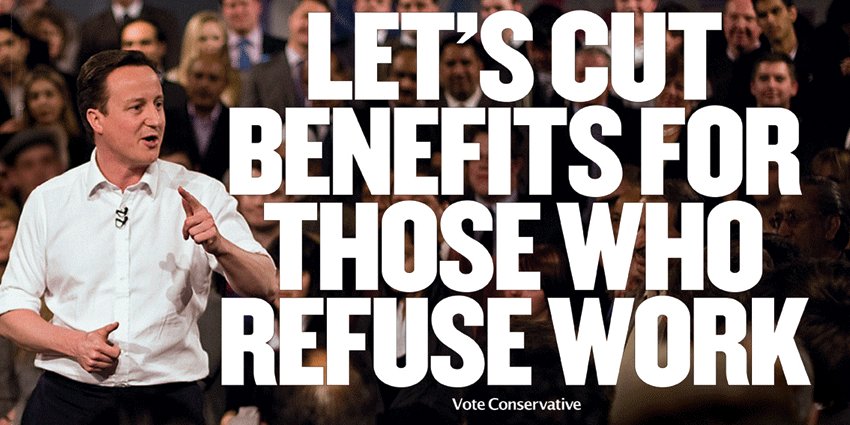

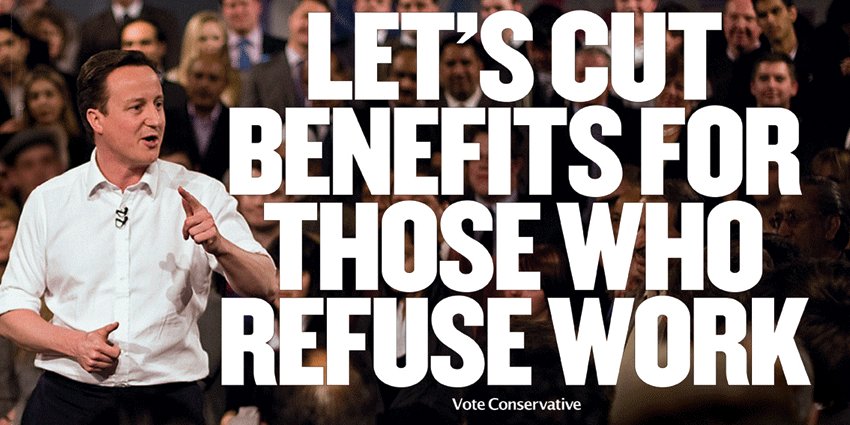

Part 1 - How it all was doomed to fail from the startOne of the things which has struck me most about all of this welfare reform is the abundance of ignorance which exists about the benefits system. There are hundreds, if not thousands of various blog posts which put forward their often illiterate views over how the work shy should work, the fraudsters who should pay and those who know 'someone on the fiddle'. It's bred a new form of hatred, it used to be racial, then homophobic; - but now it's reverted to an unhealthy hatred towards those who, for whatever reason, are reliant on the state for support. Given our economic and fiscal collapse, which frankly we' all be paying back for many years to come, I'd have thought there would have been more hatred towards the monopolist banking institutions; - however, this transpired to be short lived. Equally, politicians spend hours blaming each other, but in truth people feel resigned to not being able to do anything about bankers and politicians for they are seen as the untouchable. Instead, they choose to pick on those least able to speak back. It's a form of bullying, I'm sorry to say we are becoming a nation of bullies, it's not nice; -but it's how things are. It's also where Government has allowed itself to get carried away, it means politicians from all sides have been able to engage in tactics of distraction and courting popularity, they use it to take the focus off themselves and know that by being seen to share what they see as the 'popular view', they'll gain some degree of public support. In my view, it will transpire to be a serious mistake to have got off on such a wrong footing. I'm not sure whether I blame the media or those who feed them with the kind of headlines which I've referred to previously in this long and drawn out article. I suspect it's a mixture of both. The consequences of getting all the media hype wrong are disastrous for those who stand to be most affected by these reforms; - the genuinely disabled and incapacitated. Unfortunately, they'll be more casualties, I've referred to the tragic consequences of what's already happened to some of them. The tabloid headlines have been shown to have been a lot of hot air, time and time again. But, regrettably by the time the banner headlines appear, the damage has been done. It's fueled all of this socially regressive hatred and taken us back to the draconian days of labeling the disabled as demons and misfits, we should never return to those days - but we're well and truly headed in this deplorable direction. Far too little was said of the apologies proffered by Iain Duncan-Smith and Lord Freud over how they'd got the statistical interpretation all wrong, we mustn't forget it was this which acted as the catalyst for the irresponsible headlines which appeared and became very effective at labeling an increasingly loathed sector of society. It was the Archbishop who demanded an apology, but it was never enough. But government has made a mistake in terms of raising the expectation of it's benefit bashing supporters, government has put itself in the unenviable position of needing to live up to its headlines, or its supporters will feel badly let down. Government has made the classic mistake of setting out its reform agenda according to what it thinks the majority of voters want to see happen. In doing so, Government has paid too much attention to feeding socially destructive headlines which it now has to live up to, or else it risks being seen to let its voters down.

Government has paid far too little attention to the accuracy of its headlines and will now pay the consequences of getting the detail wrong when its reforms are shown to be unworkable.

|

|

|

|

Post by nickd on Aug 20, 2011 22:51:24 GMT 1

(53) Continued...

So are Government's plans on welfare reform simply hot air?[Part 2] Government hasn't done the right homework  Nor is its existing knowledge base the best use of resources Nor is its existing knowledge base the best use of resourcesHaving already told their supporters what they were going to deliver and after effectively advertising their promises in the tabloids; - did government simply engage with those who would tell them what they wanted to hear? In short, I think the answer isn't a straightforward yes. Indeed, Iain Duncan-Smith made a promising start on welfare reform, he's well researched his subject over the years and clearly had made an attempt to look at the root causes of welfare dependency. But where this all goes horribly wrong is in having to live up to all those benefit bashing headlines. They've made a rod for their own back from which they'll find it hard, if not impossible, to deviate. Ironically, it cripples them from being able to depart from their chosen path; - it's a disability which they'll have to accept they've irresponsibly inflicted upon themselves. The problem is this government's all too fond use of professors, report committees and endless fountains of apparent knowledge. There is simply no point in only engaging with those who share the same outset views, or when faced with challenging criticism to disengage from those who give it; worse still to commit the cardinal sin of moulding unfavourable responses until they fit hand in glove with what government says. Once you go down this route the whole exercise lacks any form of constructive value or purpose. There's little sign that Government actively engaged with any one of those who work with benefits day in and day out, those who deliver the service, those who depend on them and those who problem solve all the complexity of issues which arise out of systematic failure. Indeed Government, through the Ministry of Justice, has argued there is no need for benefit specialists within the legal aid scheme due to an apparent basic nature of all benefit enquiries; - it speaks volumes of how Government fails to comprehend the complexity. It's perverse when in other quarters, they justify spending billions to simplify what they recognise as an overtly complex system. Government issues consultations and impact assessments, but its responses show they are only paying lip service to what they are being told by those who know the system far better than any number of professors or select committees. They choose to rely on people who have never had any real experience of being at the receiving end of an overly bureaucratic claim and verification system. In short, they should have engaged with those in the know. I'm not decrying the work of the professors and the committees who have tried hard to get to grips with an understanding of the system, but understanding it is a million miles from actually dealing with it. Who am I to comment they would no doubt say; -yet, I can say with reasonable certainty that I know the difference between an ESA50, an ESA85, an A1, an IB113, an HB1, a valid supersession/revision under section SSA 9/10, a recoverable overpayment under section SSAA 71 and the split duties contained with regulation 32 of the Claims and Payments regs. I, along with hundreds of other welfare benefits specialists risk being hung out to dry as Government fails to recognise where we could actually be helping to play an active part by pointing out where complexity could be reduced, we've a major role to play but Government wants to park us up and demean the work we do. Welfare benefit specialists are in so many ways the interpretor between the confused claimant and bureaucratically bound officialdom. It was the Institute of Fiscal Studies who in their welfare paper of 2010 warned that the success or failure of these reforms was subject to identifying the devil within the detail. In my view there is an inherent danger in failing to identify the detail. Take the centre for social justice's 'Dynamic Report' for instance; - it fails to correctly identify how housing costs are not just covered by Housing Benefit (as they are with rent) but by mortgage interest payments paid as part of certain income based benefits, these mistakes elsewhere in other reports I have looked through. If you don't get the detail right through misunderstanding the system it becomes an absolutely hopeless task to attempt to reform it; it also becomes impossible to accurately quantify any fiscal savings which could be made. Equally, there are widespread gaps in sets of statistics used by various departments, they show up in one set but not another. I fail to see how any politicians can be asked to vote upon the basis of such unclear figures. Government should provide those charged with considering reform a much clearer evidence base upon which to do so. As it stands they are simply blinding those they need to convince with science; - it is this which also accounts for a great deal of the problematic media distortion. Government's agenda for successful reform must be built upon a firm evidence base inclusive of the views of those who have 'real time' experience and knowledge of the difficulties of the system they seek to simplify. Failure to recognise those who can make a valuable contribution is counterproductive as well as self defeating. It leaves Government wide open to allegations that it only seeks to reform to suit its idealogical aims, it ignores those who could constructively contribute at its peril, as ultimately it is government which is charged with successful implementation of all it has promised.

|

|

|

|

Post by nickd on Aug 21, 2011 8:33:31 GMT 1

(53) Continued...

So are Government's plans on welfare reform simply hot air?

[Part 3] A greater need for transparency, honesty and integrity [/u]  True welfare reform demands an acceptance of truth True welfare reform demands an acceptance of truthSuccessful reform will depend, as it does in many other areas, on transparency and and acceptance of the truth. No single government has an unblemished history on the delivery of welfare. It is hypocritical of the current coalition government to blame the previous administration for all that's wrong with welfare; equally there can be no denial that the Labour government failed to get to grips with the welfare state. Neither party can claim all the glory. That said, there are some changes in the provision of welfare which we should not be condemning. It's become all too easy to say everything in Britain is broken, if it is it needs a nation of fixers. If it isn't we should adhere to a straightforward policy built upon the age old adage of 'if it's not broken- don't fix it'. It will be very costly to engage in unnecessary repair. The Tory government cannot deny that it pumped millions into the creation of Disability Living Allowance in 1992 and Incapacity Benefit in 1995, under their last spell in power, unemployment rose to very high levels. It is essential to be honest over the combined figures of those who are unemployed and those who are incapacitated. Again media distortion has already played a damaging part in giving voters the wrong perception. It is absolutely vital that government doesn't put all the blame upon the feckless and work shy as well as a nation full of benefit cheats. The figures and statistics simply don't bear out the media's grossly distorted headlines. The reality is that actual fraud has been shown to account for only 0.85% of 1% of the entire benefit bill. It's still too much in monetary terms but it's far less than people are being led to believe. In the same way, the number on incapacity and unemployment related benefits has not multiplied too significantly over the course of the last administration. It is the combination of the two elements which become key in the analysis. Incapacity benefits has become a shield which allows a degree of hiding the numbers of claimants out of work. It would be foolish of government to hide from the evidence that higher mortality rates and an increase in child related disability living allowance expenditure account for a great deal of 'growth' in this sector. The nation is living longer and awareness has increased over what can be claimed to compensate for genuine disability. This kind of growth should not be confused with more of the blame game by way of suggestion that it emanates entirely from an increase in claims by those of working age. It is true that the labour government did far too little to quell welfare dependency among the long term incapacitated. They have quite correctly come under criticism for their over reliance on private welfare to work contractors such as A4E and Reed; both of which were heavily condemned by a public accounts committee for poor performance and abysmal delivery in terms of reducing the claimant count by the creation of 'real' jobs. The blame game backfires on the current coalition for these failures because they continue to offer further contracts to the very same suppliers who failed to deliver in the past. One of the key areas of reform was the introduction of the Employment and Support Allowance which was born out of the 2007 welfare reforms. The recipe is probably right; - but there must be more of an acceptance that the ingredients are all wrong. There can be no denial that the medical assessment is deeply flawed, it's been condemned by a select committee and concern over the entire process is widespread among 50 major groups representing the disabled. Macmillan, the cancer charity organisation, has condemned the process in its paper 'failing the system'. More recently, we learn that 12 of the ATOS health care professionals are under investigation by the General Medical Council. Government has to accept the rising tide of evidence against an assessment process which is increasingly coming under question. That said; the Employment & Support Allowance could work. But in order to do so Government must stop using it as a conveyor belt to get people off incapacity related benefits and onto Jobseeker's Allowance. Employment & Support Allowance is the vehicle by which those who have a limitation can get the support they need to transition them from welfare and back into work. It should not be compared with the Incapacity Benefit it replaces where the determination was over those could work and those who could not; - it's a fundamental misunderstanding of the purpose behind the allowance. It was this misunderstanding which led to the '75% on the sick are skiving' headlines appearing in the Headlines. Government incorrectly used the ESA reassessment statistics in referring to 1.9 million untested incapacity benefit claimants. It's this kind of error which will lead to disastrous reform and ultimately failure to deliver any deficit reduction. It makes no economic sense for the incoming administration to simply engage in the reversal of previous policy for the sheer sake of being seen to 'change the system'. Renaming and repackaging the Flexible New Deal into the 'Work' programme will achieve nothing unless lessons are learned from the past. Just because providers are being paid on the basis of results doesn't make it a recipe for success. A recent committee considering Private Funding Initiatives highlighted the high cost of private sector involvement. 'Buy now pay later' may absolve us of paying out the cash now but we should be under no illusion that we are eventually committing our finances to pay providers up the £14,000 per person to get them off welfare and into work. Government should also be far more cautious over its over selling of the Universal Credit. Whilst simplification is laudable, the reality is that of 51 different benefits in the UK welfare system, the Universal Credit only partially merges six. There will be huge problems in its implementation with many problems still to be ironed out in terms of alignment and putting the right IT systems in place. Government should learn lessons from the past when tax credits introduced a wave of overpayments; - back then, people had far better access to proper advice to sort problems out. Cuts in expenditure make this far less likely which will mean many thousands of people will be banging their heads against the wall through the sheer frustration of being unable to get help. There is also a need to consider the true impact of rising unemployment, lack of growth in the private sector and a larger number of students who will not find their way into higher education because of the increases in tuition fees. The increasing number of part time vacancies and extension of the working age will all impact upon real time employment related statistics. Government's biggest challenge is the creation of sustainable jobs; - not just the creation of those which appear in statistics to justify huge expenditure on welfare to work programmes. The bigger question marks remain over the cost of reform, the practicality and more accurate prediction. Government should be honest that it is conducting an experiment and dealing with unknown quantities. Government cannot promise to fix a system until they know precisely what requires repair. It is inherently dangerous to raise the voter's expectation by promising that Universal Credits will simplify the system to such an extent that problems will disappear upon implementation. Government has to accept that, as with any experiment, it is dealing with a huge variety of unknown quantities. There also needs to be more transparency and openness about the real problems which exist within the welfare structure, not least that 42% of the expenditure is related to pension provision; - an expense which rises as the mortality rate increases. It is unacceptable to blame it on the idle & worthlessness or fraudulent claims without any firm evidence base upon which to formulate such assertions.

|

|

|

|

Post by nickd on Aug 21, 2011 21:11:35 GMT 1

(53) Continued...

So are Government's plans on welfare reform simply hot air?

(Part 4) Has government really got the figures to add up?[/u]  Or are they just plucking figures from the air? Or are they just plucking figures from the air?There are many DWP statistical data tables like the one above, but are they really all that accurate? It's a fair point given the amount of error within the DWP, HMRC and Local Authorities; - where there is error, there is also the danger that any statistics produced will be inaccurate. It therefore stands to reason that government may be working off unreliable data sets. A closer analysis of Government's projected £2 billion savings by cutting ESA claims to 12 months highlights an inconsistency. Examination of the CSR at Table 3: [Spending Review AME policy measures] shows that government plans to make the following savings in reducing ESA as a time bound claim: Contributory Employment and Support Allowance: time limit for those in the Work Related Activity Group to one year: By 2011/2012 = £0 By 2012/2013 = £1,025M By 2013/2014 = £1,530M By 2014/2015 = £2,010M Making a total of £2,010,000 by 2015 A parliamentary impact assessment dated 20/4/2011 makes the following Key 'assumptions' (1) Number of people moving onto ESA through IB reassessment that are placed in the WRAG. Current assumption is nearly 900,000 over 3 years; this estimate may change. (2) Assume around 90% of people in the WRAG on contributory ESA will be time limited in the longer term. (3) Assume around 60% of those affected will be able to claim income-related ESA. (4) Primary legislation in place by April 2012. Government estimates 900,000 claimants (previously on IB) will be placed in the WRAG group over the course of 3 years; - around 300,000 a year. It has already been pointed out that there is clear need to track these IB to ESA cases, in 2010 the IFS put the number of IB cases at 1,949,300 (approx1.9 million), but this parliamentary impact assessment puts the figure at 1.5 million. On top of which there are a number of ESA 'stand alone' cases. The following are average costs (some claimants will receive different rates of both IB and ESA) Expenditure on IB cases (2010) at 1,949,300 claimants works out at £6,111,000,000 or £3,134.97 per person per annum (£60.29 per week) Source IFS Expenditure on ESA cases (2010) at 479,430 claimants works out at £1,268,000,000 or £2,644.81 per annum (£50.86 per week) source IFS Estimated average net savings of £2,000,000,000 by 2015 (in accordance with CSR) by phasing 900,000.00 claimants off ESA WRAG works out at £2,222.22 per person per year (£42.74 per week) The impact assessment addresses the uncertainty over how many ESA claimants will be able to claim income based ESA and even where they may seem to lose their entitlement it could be offset by an increase in say their mortgage housing amount which brings them back into IB ESA entitlement; - similarly there may be other rises and adjustments in related benefits/tax credits. They also foresee a large number of appeals (up to an expected 50%) but fail to appreciate how those in the ESA assessment phase cannot be placed in the WRAG group because they need to move from assessment before they can be placed in the WRAG. It also remains to be seen whether only 900,000 end up in the WRAG group. Government has based its assumptions on factors it cannot possibly know or predict with any degree of acceptable accuracy. The addition of further costs is something which will heavily impact upon net savings by 2015.The assessment details the following expenditure: There will also be administrative costs associated with the policy. These occur from the following: (A) one-off costs of changing the IT to facilitate the policy (£0.5m in 2011/12); (B) recurring costs of closing contributory ESA claims and either starting or amending an income-related ESA claim for those who qualify (approximately £30m in 2014/15); and (C) recurring costs of processing possible extra appeals (up to £30m in 2014/15). A total of £560,000 million has to be deducted from what is quite possibly an over estimated saving of £2 billion to the exchequer. The £2 billion savings reflected in the Comprehensive Savings Review do not marry with what it says in the impact assessment: Costs and benefitsThe proposal to time limit contributory ESA as set out above is expected to generate net benefit savings building up to around £1.0bn per annum by 2014/15. These are fiscal savings; there would also be equal and opposite economic costs to the individuals affected. This consists of the following elements: (A) gross fiscal savings from ceasing contributory ESA for those affected (£2.6bn in 2014/15); (B) gross fiscal costs to income-related ESA for those that qualify (£1.3bn in 2014/15); and (C) gross fiscal benefit costs due to increases to Pension Credit, Housing Benefit, Council Tax Benefit and Tax Credit payments for those whose income brought to account decreases as a result of the change. There will also be a small reduction in taxation revenue from those who lose their (taxable) contributory ESA. In total this is expected to generate a cost of £300m in 2014/15. So costs of £1.3 billion and a further £300 million fall to be deducted? There are serious inconsistencies in this one area of £2 billion estimated savings alone; - they simply don't stack up. Elsewhere, I have detailed how the number of appeals which could increase to a potential of almost 1 million per year by 2015 (which would simply be unworkable) if the appeal rates increase and reform changes are implemented across other benefits by then. It's a double edged sword;- for if the implementation isn't made, then the savings won't be found. The current rate of review on IB to ESA cases runs at around 10,000 per week. The impact assessment sets out its target of reviewing 1.5 million claims as follows: "IB Reassessment is a programme to reassess some 1.5 million people on old style incapacity benefits to see if they are eligible for ESA using the WCA between Spring 2011 and March 2014." Over the 38 month period this means the DWP will have to review 39,473 cases per month; - working out at 473,684 cases per year. On the face of it this may not appear to match an earlier prediction (see post 38) which I made that there would be around 271, 230 appeal cases as it would account for 57% of all claimants appealing. However, an important factor is one which I have continually mentioned throughout, this is how new ESA claims need to be factored in and added to the existing IB/ESA conversion caseload. I would therefore hold with the 271,230 appeal cases per year figure as quite possible. It needs to be considered that whilst the overall IB/ESA caseload may drop as people end their claims, those who are most likely to appeal are those who make a new claim in the first instance. An additional factor in so far as appeals are concerned is how many claimants will end up appealing several times over due to a continual review process conducted by the DWP on ESA claims. Government needs to work to its figures to achieve its estimated savings or else it will not achieve deficit reduction; - ultimately it is this upon which government will be judged. Government has made a fundamental mistake in not realising the complexity which exists within the benefit system and which will preclude it from making the savings it had hoped to by 2015. Government should recognise that however much it may strive for a leaner system, it will take many more years than it forecasts to achieve it. There is the additional factor of 'voter expectation' which I deal with in section 5, this will become of key importance as Government has raised its voters hopes in slashing welfare dependency, if it fails to deliver, it risks losing appeal with the electorate. www.dwp.gov.uk/docs/esa-time-limit-wr2011-ia-revised-apr2011.pdf

|

|

|

|

Post by nickd on Aug 22, 2011 8:39:58 GMT 1

(53) Continued...

So are Government's plans on welfare reform simply hot air?

(Part 5) Dave's got a lot to live up to with all his Headlines[/u]  But won't Dave just end up letting his voters down?Welfare reform will hit the following people the hardest: But won't Dave just end up letting his voters down?Welfare reform will hit the following people the hardest:* Those are who've paid their contributions and saved will find they can't get Employment & Support Allowance for any longer than 12 months; - many will find their money gets stopped completely as early as April 2012 if they've been getting ESA for the last year. Government will make savings of £2 Billion from those who no longer qualify because they've put away savings. * Despite the spiralling cost of living, Child Benefit is being frozen for 3 years after which it will rise in line with the Consumer Price Index instead of Retail Pricing, meaning squeezed families will lose out to the tune of £1 Billion pounds. Families with at least one higher tax band earner will lose their entitlement altogether; - whereas those with two just under the band will carry on getting their Child Benefit; - families will lose out to the tune of £2.5 Billion in Child Benefit. Some families with two people earning £78,000 a year will still get their Child Benefit, whereas others with one earning over £40,000 will go without.* Hard working families will lose out as Government brings in changes to Working Tax Credits. This will include freezing the basic and 30-hour elements for three years from 2011-12. Reducing the percentage of childcare costs payable from 80% to 70% from April 2011. Abolishing the 50-plus return-to-work bonus from April 2012. Change the eligibility condition so that a couple with children will need to work for at least 24 hours per week between them, with one working at least 16 hours per week, in order to qualify for WTC from 2012-13. These measures are expected to save £40, £625, £385 and £390 million per year respectively by 2014–15. The Comprehensive Savings Review sets out how Government wants to make savings of Working & Child Tax Credits to the tune of £1,185 Million pounds. Families will need to work longer to qualify and will end up with less.* Welfare reform will see £490 million being saved in localising and reducing Council Tax Benefit.* Despite government's assurances that it will create a workpool in the private sector, the reality is that it will be private welfare to work contractors who receive sums of up to £14,000 per person to 'create jobs'. The cost to the tax payer is estimated at varying sums from to £3 million to £3 billion pounds. They could work out out as high as £9 billion pounds depending on how difficult it is to get people back to work.* The implementation of Universal Credit has been hailed as the answer to simplifying the process of claiming benefits, it will mean merging 1.9 million Incapacity/ESA claims, 0.5 million ESA claims, 2.4 million Working Tax Credit claims, 5.7 million Child Tax Credit claims, 1.8 million Income Support claims, 1.4 million Jobseeker's Allowance claims and 4.7 million Housing Benefit claims. In real terms this means correctly identifying and then merging 18.4 million separate claims into one; - it's a process which will take far longer than Governments says and will be anything but smooth. * HMRC will need to sift through 7.7 million Child Benefit claims in order to work out which families will lose their entitlement; - it'll be very problematic where the self employed are concerned or where the earnings amounts are in dispute as more and more employers reduce their worker's hours. * The DWP will have to review 3.1 million Disability Living Alllowance claims as they phase in the Personal Independance Alllowance. The Comprehensive Spending Reviews highlight the first target group as these who are in receipt of the higher mobility component and are in residential care; - their mobility payment will be axed. ____________________________________________________ In total the process will require the revision of at least 29.2 million claims, all at a time when staff are being cut back and computer systems are no where near ready.

Working families and those re-entering the workplace following periods of incapacity will be faced with systematic failure and further confusion which will continue until the process is properly sorted out.

People will be left in crisis without the money they throught they'd be entitled to, the appeals system will go from overload to total meltdown and government will have taken away all proper avenues of help; - hard working people and the genuinely disabled will become very angry and ultimately feel let down by government and all its headline grabbing promises.Many thousands of working families and the genuinely incapacitated will be hit; it'll lead to many feeling let down when they were led to believe it was the feckless and idle people who were going to be singled out; - the reality is that working families will bear the brunt and pay the price.

But what price?, that's the big unknown.

|

|

|

|

Post by nickd on Aug 22, 2011 12:28:27 GMT 1

(53) Continued...

So are Government's plans on welfare reform simply hot air?

(Part 6) As the dole queues grow and the number of people reliant on benefits increases, [/u]  More and more people will be seeking redress through social security tribunals to put right systematic failure in the processing of their claims and to rectify defective decision-making caused by too much emphasis being placed on benefit refusals to meet target driven reductions in the claimant count More and more people will be seeking redress through social security tribunals to put right systematic failure in the processing of their claims and to rectify defective decision-making caused by too much emphasis being placed on benefit refusals to meet target driven reductions in the claimant countHow bad could it get? (A) So we've already dealt with a potential 183,750 number of IB to ESA transfer cases. (B) On top of which we have the 'new claim ESA's, currently running at 197,400 in 2010/2011. This will fall as it represents the 'new claim (since October 2008) group and the accent will probably turn more towards the existing IB/ESA transfer cases. None the less we know from the previous figures that new claims run at around 27,000 to 30,000 new claims a month from the Oct 08 to August 2010 figures (These cannot have included any IB to ESA transfers). Let's use the 27K figure and assume people continue appealing at a rate of 27%; this works out at 87,480 appeals per year. (27K X 12 = 324000 - of which 27% is 87,480).(C) The 87,480 figure for new ESA's is added to the 183,750 ESA transfers; giving a potential 271, 230 total IB-ESA/ESA appeals per year. Now add the other groups.(D) JSA appeals 2010/2011 figures show there were 47,000 (or 11%) for Job Seeker’s Allowance (JSA) appeals. This represents an increase of 51% on the previous year. Now we know a large number of ESA claimants are being found 'fit for work' or they abandon their claim. These run at around 900,000. Of the 900,000, a certain amount will go to the Jobcentre and do battle over getting them to accept they are 'fit, ready and able to work'. These are the basic JSA claim conditions; - you need to bear in mind these are people who had previously tried to claim on the grounds of incapacity. The Jobcentre will feel uneasy as accepting some of these claims because they are the people who are essentially saying to employer's 'we've got lots of people here who can work'. It will undoubtedly lead to claim related problems. In addition to which there will be an increasing number of sanction related appeals as the number of JSA claims grow. There are currently around 1.4 million JSA claims according to certain sets of figures, others put it in excess of 2 million. A problem in the statistics is over the merging of IB/ESA cases onto JSA as these represent a 'transient' claim group. Let's go with with 1.4 million but add in around 300,000 which is likely to reflect job losses in the public sector. I'm being conservative with the figures and reckon 1.7 million is fairly representative. Assume 25% appeal. Bear in mind the fraud detection measures as well; these will lead to overpayment related appeals as people contest allegations they 'were working on the side' or 'not declaring a partner'. Here's the maths: 1,700,000 JSA claims, 25% appeal = 425,000/4 years = 106,250

There's a potential 106,250 additional JSA appeals per year, many won't succeed, but it won't stop people appealing. (E) 83,600 or 20% were for Disability Living Allowance/Attendance Allowance (DLA/AA) appeals; - up by 11% on the previous year. Why? Well, a lot of these will be tied to claimants who have had their long term IB claims transferred to ESA. These will flag up inconsistencies in the claim criteria for DLA due to the strict nature of the activity descriptors. Take a claimant on DLA higher rate mobility who has been on IB for years. The ESA assessment (in the current strict form) is likely to find the claimant to have no significant walking impairment to the degree that they are are entitled to the DLA mobility component. Similarly care awards are likely to be affected too. Now the IFS claim figures for 2009/2010 show there were 3.1 million DLA claims. That's 3,100.000 and we all know how this is going to backfire. Remember, the implementation of Personal Independence Payment will put pressure on the DWP to 'clean up claims' prior to the implementation of PIP. It will throw up many retrospective entitlement appeal issues. 3,100,000 DLA claims, 20 % appeal = 620000 / 4 years = 155,000 So that could be another 155,000 DLA appeals per year into our already bursting point TribunalsSo far we have:

155,000 DLA Appeals

106,250 JSA Appeals

271,230 ESA/IB Appeals

532,480 Sub TotalHere's a reaonable prediction of what will happen to the following benefit related appeals, I've already explained why.(F) Income Support - Total Claims 1,800,000.00, let's say 10 %appeal making 180,000.00 appeals to be heard by 2015 or 45,000 per year.(G) Tax Credits - Total Claims 8,100,000.00, let's say 10% appeal making 810,000.00 appeals to be heard by 2015 or 202,500 per year. (H) Child Benefit - Total Claims 7,700,000.00, let's say 2% appeal making 154,000.00 appeals to be heard by 2015 or 38,500 per year. (I) Housing Benefit/CTB - Total Claims 4,700,000.00, let's say 6% appeal making 282,000.00 appeals to be heard by 2015 or 70,500 per year.In total these additional appeals could add an enormous 1,426,000.00 appeals to be heard by 2015 or 356,500 per year

which needs to be added to the 532,480 we already have and we end up with 888,980 additional social security appeals per year; - not including some of the others such as Pension Credit, Industrial Injuries etc etc. Read more: mylegal.org.uk/index.cgi?board=frontline&action=display&thread=405&page=2#ixzz1Vl6tkAoMThe remaining benefits in the system are: (J) Attendance Allowance - with 4200 appeals receipts in 2010/2011 - let's predict a 3% increase, making 4,326 per year

(K) Bereavement benefits stood at 500, say an increase of 2% which gives us 510 per year

(L) Carers Allowance were 1,600 - a higher rate of increase at 12% seems probable given all the accent on disability related appeals -upping the figure to 1,792 per year

(M) Child Support Allowance appeals were 3,700 - now I'd guess cash strapped parents might push this up at around 15% giving us an extra 555 appeals - making 4,255 appeals per year.

(N) Compensation Recovery Unit appeals were 370, let's those at the same figure and keep them at 370.

(O) Health in Pregnancy, was 390 - we'll keep it the same so 390

(P) Home Responsibility Protection was 25. An increased awareness over pension related issues may push this up by a nominal margin, it won't be much so let's just say 26 appeals.

(Q) Industrial Injuries Disablement Benefit was 9,200, now a larger increase seems more probable because this is being 'reformed' and disputes are more likely to go to appeal. Applying a 15% increase puts this up by 1380 giving us 10,580 appeals.Now the sum total of all of these appeals was 27,853 in 2010/2011 and the above predicted increases would take this up to 30,64.20We add this to our existing 888,980 and end up with a figure of 919,628 - it's a phenomenal increase.

Remember how CAB were claiming that £16 billion went unclaimed per year, what on earth would happen if all those highly effective benefit take up campaigns started up again? - it would almost certainly end in some disputes and push our annual appeal figures over one million a year; - the Tribunals could never cope.

So there we have it, now I would say this was a perfectly valid and well reasoned argument as to how these Tribunal appeals are set to increase very dramatically. ____________________________________________________ Government's answer to the appeals crisis is much the same as was in the recent riots, it increases the court's capacity by employing more judicial panel members, including Judges, with an increase in its number of judicial sitting days to deal with the problem; - it's going to be expensive. It's against the grain of all the anti-litigation measures which government otherwise says it wishes to encourage. Even with the recent merger between HM Courts Service and The Tribunals Service, there are a limited number of venues and administrative staff to deal with such an increase. The number of ESA appeals has increased by a massive 167% from 2008 to 2010; - this is the first benefit which now sits on the first rung of the government's welfare reform ladder. At around 29 million claims to go through, there's enormous scope for further appeals on an unprecendented level. Government has said far too little about the reduced rights it will be giving appellants to formally dispute decisions on overpayments. It unwisely proposes legislation which will see a form of compulsory reconsideration; - claimants will be expected to try and resolve their complaints before going to appeal. This will have a profound effect in further delaying claims and will serve no constructive purpose whatsoever unless people are helped by those with the knowledge to help put matters right. It is only with appropriate levels of help that claimants may be able to resolve their disputes without having to take them to Tribunal. Government should be very wary of simply making the process so complicated that it simply puts people off when it comes to challenging the state. Government has put a great deal of emphasis on sanctions for non-compliance when it comes to the claimant, yet it has done little to convince any one that official error will be erradicated to any significant degree. It seems perverse to impose so many anti-claimant measures, whilst taking away all practical routes of appeal including access to professionals who could help claimants sort out the issues which without doubt will arise; - it's short-sighted and socially irresponsible to pay only lip service to the rights of claimants to contest the state. Read more: mylegal.org.uk/index.cgi?board=frontline&action=display&thread=405&page=2#ixzz1Vl7PH3Jl

|

|

|

|

Post by nickd on Aug 22, 2011 15:13:55 GMT 1

(53) Continued...

So are Government's plans on welfare reform simply hot air?(Part 7) The million dollar question But can Government's answer it?How long is a piece of string? But can Government's answer it?How long is a piece of string? The inherent problem with this one is the sheer number of unknowns. Government has announced all of its predicted savings on the basis of the great unknown and in many ways the unquantifiable. Let's look at it section by section. ____________________________________________________ Predicted savingsIn the comprehensive spending review, George Osborne predicted savings of £7 billion on the welfare bill by 2015. But let's see what we can make of some of the figures which have been flying around, I'll break them down into the relevant sections. ____________________________________________________ Welfare to work This area has to be the greatest unknown of them all. It's apparent that the chancellor and the welfare minister are at loggerheads. In June 2010 as part of his budget speech, predicted savings of £11 billion in the welfare bill by 2015. The Economist refer to deal broking between the two: "After tense haggling a deal seemed to have been struck over the summer. Mr Duncan Smith could have his reform, at a cost of £3 billion a year, provided that, as well as the £11 billion of welfare cuts already announced, his department contributed £10 billion of net savings in 2014-15." www.economist.com/node/17103794It's not even fully clear how much government intends to save, let alone spend. But it seems the welfare minister has a £3 billion cheque book as far as his measures go; - but he's got a lot to deliver in return.Earlier in this article, I drew attention to how welfare to work was going to cost between £0.3bn and £3bn. Other reports contained within this article put it at £7bn. The launch of the Work programme in June 2011 puts the figure at £5bn; - "Many of the roles will be created in private companies including security firm G4S, A4E and Serco, with the total value over the contracts likely to be between £3bn and £5bn" www.epolitix.com/latestnews/article-detail/newsarticle/welfare-to-work-scheme-launched-1/Read what the DWP 'Work' prospectus says www.dwp.gov.uk/docs/work-programme-prospectus.pdfDWP press release (£3-£5n) www.dwp.gov.uk/newsroom/press-releases/2011/jun-2011/dwp062-11.shtmlHear the Select Committee and all their doubts www.youtube.com/watch?v=GhbQE6qY3nA&feature=player_embeddedIt has been reported that welfare to work providers are to be paid sums of between £2,000 and £14,000 per person to get them back into work. The numbers of those claimants being helped by providers varies according to the source of the information. The DWP put it at 2.5million claimants over 5 years. Using my previous estimates and applying 'graded' payments, the cost could be as follows: If it is assumed that 25% of all claimants were regarded as the 'least' difficult, there would be 475,000.00 cases payable at say £2,000 per case. The total cost to the state would be £950,000,000.00 in fees payable to welfare to work providers. Assuming 10% of all cases are the most 'difficult', there would be 190,000.00 cases at the higher provider payment of £14,000 and this would cost cost us all a huge figure of £2,660,000,000.00; - a very significant sum. Looking at the remaining 65% of all these claimants and assume they are 'moderately average' and attract a provider fee of let's say £5,000 per case. Now the claimant count would be 1,235,000.00 cases and the total amount in provider fees would amount to a massive £6,175,000,000.00; - a massive sum of money. The total sum could be as high as £9,785,000,000.00. [the above figures are based on 1.9 million IB cases as per the 2010 IFS figures; - all of which have to be transferred to ESA] So who's right?I would suggest there will transpire to be a difference of opinion between Government and welfare to work providers. A report released in June 2011 'Opening Up Work For All' and produced by the Centre for Economic & Social Inclusion outlines what is probably the most responsible approach to recognising the problems of long term welfare to work dependancy and transition in to the workplace. The same report refers to a further paper 'Inclusion' and states how 2.7 million 'starts' could be introduced in to the Work programme by 2014; it goes on to state: This chart shows the predicted very large proportion of customers who will have previously claimed ESA or IB. Many of these customers will have longstanding health problems. For example in the research on Pathways to Work, the majority of customers had had their health condition for over five years (Sejersen et al, 2009). The ESA evaluation found health to be by far the largest barrier to work for ESA customers, and this applies to the ‘fit for work’ group as well as other customers: nearly half (46 per cent) of the fit for work group identified their health

as the main barrier to work, far higher than other barriers (Barnes et al, 2010).The report refers to problems of incorrect assessment and could be indicative of a perception by welfare to work providers over the identification of larger numbers of potential recipients than the Government is prepared to pay for. Doubts have already been raised which reflect a view that up to 90% of W2W contracts could fail in meeting their contracts. The W2W forecasts suggest it is more appropriate to work on the basis of a higher recipient figure than the DWP seem to have allocated in their £3 predicted expenditure. What is clear is the W2W providers must do significantly better than A4E and Reed did when delivering contracts under the Flexible New Deal scheme. A public accounts committee hauled them over the coals for their low figures on actual delivery against set targets. Read the report: indusdelta.co.uk/sites/indusdelta.co.uk/files/assessment_final.pdf Perhaps, it's better to apply some government predicted figures by using the 900,000 claimants which government believe will fall into the ESA WRAG group by 2015 (as per their ESA impact assessment on the 1 year limiting); - it's what they predict of their own figures. But how would it translate into welfare to work provider payments? Out of the 900,000 group Assume 10% result in a provider payment of £14,000 per person (most difficult cases) = 90,000.00 X £14,000 = £1,260,000,000.00 Assume 90% result in a provider payment of £5,000 per person (moderate case) = 810,000.00 X £5,000 = £4,050,000,000.00 Making a total of £5,310,000,000.00 (£5.3 billion in W2W payments) In my view this could be an underestimate as all claimants are in the WRAG group and providers may say they are therefore more 'difficult'; - they would attempt to justify a higher fee. The other problem with this it includes none of the 3.1 million DLA claimants who will be reassessed as part of the PIP transfers; - it could considerably increase the provider payments. It should not be forgotten that all DLA claimants qualify because they have a severe disability. You have to assume some will fall into the welfare to work groups. The unknowns are the pace & timetable, the numbers found to have limitation and the number of appeals which lead to overturned decisions. Another unknown factor is the 'grading' of welfare to work provider payments; - they need to explain how they will identify a difficult case as distinct from a relatively straightforward case. The true figure on welfare to work costings could be anything between £5.3 and £9.7 billion pounds; - far in excess of the lowest estimate at £0.3 billion. ____________________________________________________ DWP/HMRC administrative costs It's not quantified as to exactly how much the actual administration side of this will cost, it tends to be broken down on each individual impact assessment. However, what we know is that Government wants to implement Universal Credit as soon as it can. There are 18.4 million claims to merge and even at a basic 'administrative' charge of say this still accounts for a considerable sum; 18,400,000 X £25 = £460,000,000. On top of which you could apply the same to the 3,100,000 DLA claims which are to be transferred over to Personal Independence Payment; 3,100,000 X £25 = £77,500,000 The IB to ESA's are more quantifiable because they are underway. The impact assessment on ending the ESA claims periods after 1 year for those on contribution based ESA mentions a 'recurring' cost of £30,000,0000 in dealing with the transfers, but this only deals with these cases. I've already set out why this figures should not be accepted as the rate of pace in reviewing shows that the DWP are targeted at processing IB to ESA cases at the rate of 10,000 cases per week which from February 2011 (when the roll out of reviews commenced) until March 2015 (which is reasonable as government will need to show significant progress before next Parliament) is over the 54 month period - 54 months X 40,000 cases per month = 2,160,000 cases by March 2015 which fits more in line with Government's targets to review all IB cases, I'm not convinced it allows for new ESA claims but in dealing with these 2,160,000 cases the administrative cost would add a further 2,160,000 X £25 = £54,000,000. (these are over and above Universal Credit cases as they form a separate type of review). I leave aside an in depth analysis of the Child Benefit reviews and other benefits for now. Although I am mindful that the chancellor proposes making savings of £2.5 billion in this area. A DWP report [ The Pension, Disability & Carers Annual Report 2010/2011 dated July 2011 states: " We have faced a challenging twelve months; focusing on areas where we could make savings while not affecting our ability to make a real difference to people’s lives. In 2010/11 the total funding made available for administering pensions, benefits and entitlements to our customers was £841.8 million. This funding helped us deliver £100.2 billion in benefits and entitlements. These accounts report on the costs of paying these benefits and entitlements." Which effectively means that to deliver benefit payments of £100.2 billion, the administrative cost was £841.8 million. For every £10.20 paid in benefits it costs around £84p to deliver them; but how inclusive is this cost? www.official-documents.gov.uk/document/hc1012/hc11/1128/1128.pdf

Using the DWP Pension, Disability and Carer's report we know that the claimant count is 16 million which costs £100.2 Billion. (£100,200,000,000.00) divided by 16,000,000.00 (16 M) = £6,262.50 per person. We also know that the admin costs run at £841,800,000 Million which is 0.85% of 1% (approx) of the £100.2billion overall cost.

If the £6,265.50 per person is divided by the 0.85% the admin costs run at £53.23 per case. This would need to be applied to the larger figure of claimants subject to welfare reform review, this being all those reviewed for the Universal Credit (around 18M) 3.1 M for PIP and then the 1.9 to 2.4 IB/ESA cases at £53.23 per case. This could arguably be applied as follows:

18,000,000 Universal Credits cases + 3,100,000 DLA to PIP cases + 2,400,000 IB/ESA cases = 23,500,000 (23.5 Million)total @ £53.23 per case = £1,250,934,375.00 (£1.25 Billion). This would represent an average figures using the DWP's own cost estimates applied accross disability, pension and carer's cases, it does not seem unreasonable to assume it applies accross all cases.

However, if we verge on the lower side for administrative costs alone, at a basic minimum expense of say £25 per case, this amounts to £591,500,000. This is of course dependent on how many cases the DWP, LA's and HMRC can physically process, as well as what their administrative costs actually amount to amounts to. It should be borne in mind that the admin work involved in a new benefit case is likely to be considerably more than the routine processing of a pre-exisiting claim.

The admin figures could range from £0.6 billion to £1.25 billion, although it completely depends on the level of work involved and the numbers of cases reviewed by 2015.

____________________________________________________

Fraud & Error

Lord Freud has committed £425,000 to this in his DWP/HMRC 'Fraud & Error' report of 2010.

But did he factor in the 200 extra fraud officers in the impact assessment relating to the single fraud service? Did he factor in the 'Bounty Fees payable to firms like G4S when they catch all those benefit thieves out: - it doesn't seem like they've been included. The problem with fraud detection is you just can't quantify it, it's only when people are caught and admit of are convicted of a fraud that you can safely label them a fraud statistic; - it's an area where the actual evidence shows fraud has been reduced and in 2010 stood at 0.85% of just 1%; - anything over and above is pure supposition.

It is probably here where the chancellor and welfare minister are at loggerheads. IDS wants to press on with welfare to work and Osborne wants him to deliver more savings. Fraud is an area where you can't really commit money to an evidence basis which shows a very low number of actual fraud cases. Around half a billion is already committed on the spend by Lord Freud, but is the hope that private fraud busters will deliver more by using IT as a means of cross reference between say the electoral roll, NHS records, credit reference agencies; - I rather suspect it is. Even loyalty cards can potentially be used to track whether expenditure matches a 'sole claimant' case. It may be see as an as an infringement on the rights of an individual, but that can be over-ridden in cases where fraud is suspected.

What of weekly benefit subsidies paid to LA's for the detection of fraud? - they have to be paid out by the exchequer. The IT costs are likely to be increased within the DWP/HMRC/LA's but this is where private contractors may say they already have the infrastructure; - but they'll want paying for it.

The following link shows the emphasis upon private fraud detection and states between £17 Billion and £25 billion can be saved with the DWP; - little is said of the cost except a reference to a cost to saving ratio of 1 in 10. At £25 billion this would put costs at £2.5 billion. The report outlines the measures which the fraud taskforce will take and continually outlines how much they could save, with little mention of any cost structure. The measures suggested are unlikely to attract public support as they are likely to seen as too intrusive and have the potential to impact many people and seen as the adoption of 'big brother' tactics. Read the report...(public sector fraud taskforce)

www.attorneygeneral.gov.uk/nfa/WhatAreWeSaying/Documents/Smarter%20Government%20Public%20Sector%20Fraud%20Taskforce.pdf

I think it reasonable to suggest fraud and error measures will cost far more than £425 million; - at least a billion seems to be a bare minimum and potentially will be far more if full implementation is made of all the measures contained within the taskforce report. Again, it is the cost of 'payment by result' private contractors which is not included in the equation; - the fact remains that the costs will have to be included at some stage and therefore fall to be deducted from treasury savings.

____________________________________________________

Appeals

Again unknown numbers make it impossible to quantify cost. However, the impact assessment relating to the implementation of the cessation of contribution based ESA after 12 months makes it clear that £30 million is set aside to deal with the 'recurring' costs of the DWP dealing with the additional workload of appeals. It's fairly safe to use the 2010/2011 appeal numbers and base an estimate of appeal related costs upon them. Using these figures enables a cost of around £150 per case to be identified as the appeal related 'administrative' cost which is born by the DWP; - similarly, it could equally be applied to the HMRC and Local Authorities.

The £150 would cover the cost of dealing with preparing the case against the appealant, issuing decision letters, processing appeals to the Tribunals Service and writing appeal submissions often running to many handreds of pages when evidence is included, in addition to which the cost of sending a presenting officer to the Tribunal needs to be included. Where a representative acts for the appellant, papers will need to be sent to them as well.

If the 2010/2011 Social Security appeal statistics are used as a likely minimum basis for estimating the folllowing figures are arrived at:

[Using 2010/2011 appeal receipts and applying the same set of figures for each year up to 2015 @ £150 per case for Appeal related costs]

2010/2011 418,500 £150.00 £62,775,000.00

2011/2012 418,500 £150.00 £62,775,000.00

2012/2013 418,500 £150.00 £62,775,000.00

2013/2014 418,500 £150.00 £62,775,000.00

2014/2015 418,500 £150.00 £62,775,000.00

A total number of 2.092,500 appeal receipts at £150 per case for these admin costs would total £313,875,000.00

NOTEThe costs associated with appeal administration are presumed to be 'inter-departmental'. This is an area which lacks clarity as with all government departments there are defined budgets for each department and ministers are obviously keen to work within 'their' budget rather than overlap with another department's costings. The question this raises is how 'inclusive' the appeals costs are? I cannot see how the sum of £150 would cover the full cost of an appeal, there are bound to be separate costs carried by HM Courts & Tribunals Service which fall within the Ministry of Justice budget. There is also a budget division between the Chancellor's budget within HMRC and the budget relating to Works & Pensions.

So what of the actual tribunal costs? These are the costs associated with running and maintaining the entire social security Tribunal 'estate' (not including other Tribunals it deals with such as Employment cases). These include the operational costs of arranging hearings, administration, dealing with the parties, arranging differently constitued panels with judges, medical members, disability panel members, clerks, photocopying, telephone and letter writing; - not forgetting the inclusion of IT to ensure the Tribunals Service can cope with the workload. There is also the cost of running a national service with renting premises to provide suitable venues, some of which are being heard in County Courts. There will also be a cost associated with processing appeals to the Upper Tribunals, setting aside decisions, providing statements of reasons and issuing case management directions on interlocutory referral. A further cost is the expenses paid to witnesses, panel members and appellants.

I cannot see a quantified cost but £350 per case (making a total of £500 per appeal when DWP/HMRC and LA costs are included) does not seem unreasonable.

At £350 per case the folllowing costs are incurred (again using 2010/2011 appeal receipt statistics:

2010/2011 418,500 £350.00 £146,475,000.00

2011/2012 418,500 £350.00 £146,475,000.00

2012/2013 418,500 £350.00 £146,475,000.00

2013/2014 418,500 £350.00 £146,475,000.00

2014/2015 418,500 £350.00 £146,475,000.00

A total number of 2.092,500 appeal receipts at £350 per case for these Tribunal costs would total £732,375,000.00

A total number of 2.092,500 appeal receipts at a combination of the £150 DWP admin costs + £350 per case for the Tribunal costs would total £1,046,250,000.00 by 2015.

See below:2010/2011 418,500 £500.00 £209,250,000.00 2011/2012 418,500 £500.00 £209,250,000.00 2012/2013 418,500 £500.00 £209,250,000.00 2013/2014 418,500 £500.00 £209,250,000.00 2014/2015 418,500 £500.00 £209,250,000.00 But what if the number of appeals soar even further, as I worked out they may in my earlier post at (53 Part 6); - what if the number doubled, as some predict they will, what kind of a an impact on cost would there be if there were 919,628 appeals per year?

Here's what it would mean...A phenominal increase in numbers and cost 2010/2011- 919,628 @ £500.00 = £459,814,000.00 2011/2012- 919,628 @ £500.00 = £459,814,000.00 2012/2013 -919,628 @ £500.00 = £459,814,000.00 2013/2014- 919,628 @ £500.00 = £459,814,000.00 2014/2015 -919,628 @ £500.00 = £459,814,000.00 It would mean a huge number of appeals of around 4,598,140(4.5 Million Case by 2015) at the cost of £2,299,070,000 by 2015 (£2.3 Billion). NOTE I do not think Government can dismiss amounts like this as they have no control over the numbers who can appeal and they are worked out accross the board to cover the full range of social security appeals. We've seen uprecendented increases in the numbers of appeals already and the trend is obviously going to be upwards.

What government has not done is set out a clear timetable to its decision-makers on how other benefits can impact upon others, I have already given examples of how an adverse ESA finding could bring a claimant's DLA into question, which in turn could impact upon their Housing & Council Tax Benefit and say Carer's Allowance.

Plus, if there is the pronounced emphasis on fraud & error detection on the scales indicated by the taskforce, a whole wave of appeals could be generated on the back of them, people are much more likely to appeal when overpayment related decisions are made. New laws on limited right of appeal (as in the welfare reforms) won't extend to retrospective removal of a claimant's benefit; - they will retain a right of appeal.

However, there does the time when the numbers of appeals has to be determined by capacity within the infrastructure to deal with it. You could end up with a situation where you have huge numbers of appellants insisting upon an appeal, but a Tribunals Service which can only deal with around half the numbers they are presented with.

Moves to introduce compulsory reconsideration (as set out in the reforms) will only add to the time taken to process appeals; - this will only serve as having a constructive purpose if there is a genuine attempt to reconcile the differences between the state and the appellant. It will only get worse if all avenues of help are withdrawn.